Can I Write Off Leased Vehicle . However, that changes if you’re a. If you lease a new car for use in your business, you will. You generally can’t claim section 179, bonus depreciation, or regular depreciation if you. if i lease a vehicle, can i deduct the cost of the lease payments plus the standard mileage rate? can you write off a car lease? if you use a vehicle as part of your business operations, such as to deliver products or drive to worksites, your company may be eligible. can you write off a car lease? how much can you write off on a leased vehicle? For 2024, the rate is 67 cents per mile driven for business purposes. The irs includes car leases on their list of eligible vehicle tax deductions. leasing a business vehicle. claiming a car lease tax deduction: Standard drivers cannot write off a leased car used for private mileage only.

from www.sampleforms.com

Standard drivers cannot write off a leased car used for private mileage only. leasing a business vehicle. The irs includes car leases on their list of eligible vehicle tax deductions. can you write off a car lease? if i lease a vehicle, can i deduct the cost of the lease payments plus the standard mileage rate? However, that changes if you’re a. how much can you write off on a leased vehicle? If you lease a new car for use in your business, you will. if you use a vehicle as part of your business operations, such as to deliver products or drive to worksites, your company may be eligible. claiming a car lease tax deduction:

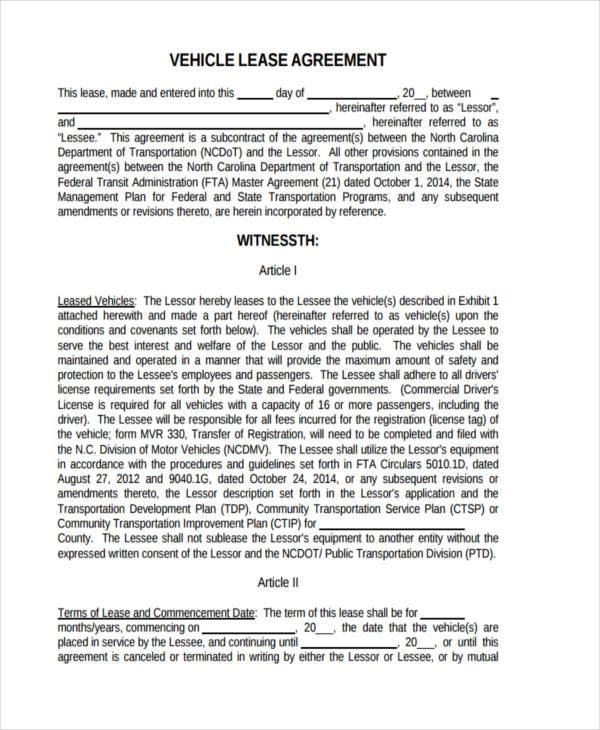

FREE 8+ Car Lease Agreement Samples in MS Word PDF

Can I Write Off Leased Vehicle claiming a car lease tax deduction: can you write off a car lease? if you use a vehicle as part of your business operations, such as to deliver products or drive to worksites, your company may be eligible. However, that changes if you’re a. can you write off a car lease? how much can you write off on a leased vehicle? The irs includes car leases on their list of eligible vehicle tax deductions. leasing a business vehicle. Standard drivers cannot write off a leased car used for private mileage only. If you lease a new car for use in your business, you will. You generally can’t claim section 179, bonus depreciation, or regular depreciation if you. claiming a car lease tax deduction: if i lease a vehicle, can i deduct the cost of the lease payments plus the standard mileage rate? For 2024, the rate is 67 cents per mile driven for business purposes.

From www.doctemplates.net

Writing an Auto Lease Termination Letter (Samples & Templates) Can I Write Off Leased Vehicle leasing a business vehicle. If you lease a new car for use in your business, you will. Standard drivers cannot write off a leased car used for private mileage only. The irs includes car leases on their list of eligible vehicle tax deductions. can you write off a car lease? if you use a vehicle as part. Can I Write Off Leased Vehicle.

From www.pinterest.com

Your vehicle is one of the best write offs you can have in your Can I Write Off Leased Vehicle However, that changes if you’re a. If you lease a new car for use in your business, you will. claiming a car lease tax deduction: can you write off a car lease? You generally can’t claim section 179, bonus depreciation, or regular depreciation if you. if i lease a vehicle, can i deduct the cost of the. Can I Write Off Leased Vehicle.

From www.youtube.com

How To Write Off Your Vehicle Exclusively For Your Business Tax Can I Write Off Leased Vehicle leasing a business vehicle. Standard drivers cannot write off a leased car used for private mileage only. You generally can’t claim section 179, bonus depreciation, or regular depreciation if you. can you write off a car lease? if i lease a vehicle, can i deduct the cost of the lease payments plus the standard mileage rate? For. Can I Write Off Leased Vehicle.

From hardysigns.co.uk

Can My Business Signwrite a Leased Vehicle in 2021? Hardy Signs Can I Write Off Leased Vehicle You generally can’t claim section 179, bonus depreciation, or regular depreciation if you. The irs includes car leases on their list of eligible vehicle tax deductions. claiming a car lease tax deduction: For 2024, the rate is 67 cents per mile driven for business purposes. However, that changes if you’re a. if you use a vehicle as part. Can I Write Off Leased Vehicle.

From www.carsalerental.com

Can I Write Off Sales Tax On A Leased Car Car Sale and Rentals Can I Write Off Leased Vehicle However, that changes if you’re a. can you write off a car lease? how much can you write off on a leased vehicle? Standard drivers cannot write off a leased car used for private mileage only. For 2024, the rate is 67 cents per mile driven for business purposes. can you write off a car lease? . Can I Write Off Leased Vehicle.

From www.taxsavingspodcast.com

How Do I Write Off a Business Vehicle? Can I Write Off Leased Vehicle If you lease a new car for use in your business, you will. The irs includes car leases on their list of eligible vehicle tax deductions. if you use a vehicle as part of your business operations, such as to deliver products or drive to worksites, your company may be eligible. can you write off a car lease?. Can I Write Off Leased Vehicle.

From www.sampletemplates.com

5+ Sample Car Lease Agreements Sample Templates Can I Write Off Leased Vehicle can you write off a car lease? leasing a business vehicle. if i lease a vehicle, can i deduct the cost of the lease payments plus the standard mileage rate? The irs includes car leases on their list of eligible vehicle tax deductions. claiming a car lease tax deduction: For 2024, the rate is 67 cents. Can I Write Off Leased Vehicle.

From www.template.net

16+ Vehicle Lease Agreement Templates Free Downloads Can I Write Off Leased Vehicle leasing a business vehicle. can you write off a car lease? You generally can’t claim section 179, bonus depreciation, or regular depreciation if you. The irs includes car leases on their list of eligible vehicle tax deductions. can you write off a car lease? However, that changes if you’re a. claiming a car lease tax deduction:. Can I Write Off Leased Vehicle.

From allanoessay.blogspot.com

How To Write A Letter To End Car Lease Allan Essay Can I Write Off Leased Vehicle claiming a car lease tax deduction: However, that changes if you’re a. can you write off a car lease? can you write off a car lease? You generally can’t claim section 179, bonus depreciation, or regular depreciation if you. how much can you write off on a leased vehicle? If you lease a new car for. Can I Write Off Leased Vehicle.

From templatedocs.net

Ways to Write Good Lease Termination Letter Can I Write Off Leased Vehicle Standard drivers cannot write off a leased car used for private mileage only. can you write off a car lease? how much can you write off on a leased vehicle? if you use a vehicle as part of your business operations, such as to deliver products or drive to worksites, your company may be eligible. if. Can I Write Off Leased Vehicle.

From sanedriver.com

How to Write Off a Car Lease with an LLC Sane Driver Can I Write Off Leased Vehicle can you write off a car lease? leasing a business vehicle. Standard drivers cannot write off a leased car used for private mileage only. if you use a vehicle as part of your business operations, such as to deliver products or drive to worksites, your company may be eligible. claiming a car lease tax deduction: You. Can I Write Off Leased Vehicle.

From esign.com

Free Commercial Letter of Intent to Lease PDF Word Can I Write Off Leased Vehicle claiming a car lease tax deduction: if i lease a vehicle, can i deduct the cost of the lease payments plus the standard mileage rate? can you write off a car lease? how much can you write off on a leased vehicle? However, that changes if you’re a. Standard drivers cannot write off a leased car. Can I Write Off Leased Vehicle.

From www.keepertax.com

Writing Off a Car Ultimate Guide to Vehicle Expenses Can I Write Off Leased Vehicle If you lease a new car for use in your business, you will. For 2024, the rate is 67 cents per mile driven for business purposes. can you write off a car lease? if i lease a vehicle, can i deduct the cost of the lease payments plus the standard mileage rate? if you use a vehicle. Can I Write Off Leased Vehicle.

From sharell-silverstone.blogspot.com

how to negotiate a car lease buyout sharellsilverstone Can I Write Off Leased Vehicle You generally can’t claim section 179, bonus depreciation, or regular depreciation if you. can you write off a car lease? if you use a vehicle as part of your business operations, such as to deliver products or drive to worksites, your company may be eligible. claiming a car lease tax deduction: Standard drivers cannot write off a. Can I Write Off Leased Vehicle.

From www.realcartips.com

Sample Car Lease Agreement with Explanations Can I Write Off Leased Vehicle can you write off a car lease? For 2024, the rate is 67 cents per mile driven for business purposes. can you write off a car lease? claiming a car lease tax deduction: how much can you write off on a leased vehicle? if you use a vehicle as part of your business operations, such. Can I Write Off Leased Vehicle.

From www.leaseguide.com

Car Lease Steps and Process Explained by Can I Write Off Leased Vehicle If you lease a new car for use in your business, you will. if i lease a vehicle, can i deduct the cost of the lease payments plus the standard mileage rate? Standard drivers cannot write off a leased car used for private mileage only. can you write off a car lease? For 2024, the rate is 67. Can I Write Off Leased Vehicle.

From www.youtube.com

How to Write Off Your Car Expenses (Vehicle Tax Write Offs) YouTube Can I Write Off Leased Vehicle The irs includes car leases on their list of eligible vehicle tax deductions. how much can you write off on a leased vehicle? can you write off a car lease? can you write off a car lease? However, that changes if you’re a. leasing a business vehicle. You generally can’t claim section 179, bonus depreciation, or. Can I Write Off Leased Vehicle.

From www.keepertax.com

Can I Write Off My Car Payment? Keeper Can I Write Off Leased Vehicle Standard drivers cannot write off a leased car used for private mileage only. However, that changes if you’re a. can you write off a car lease? claiming a car lease tax deduction: how much can you write off on a leased vehicle? if i lease a vehicle, can i deduct the cost of the lease payments. Can I Write Off Leased Vehicle.